At the close of 2015, consumer confidence in the Philippines held steady at 117 points (no change from Q3 2015) to register the highest index score in Southeast Asia and the second globally, according to the latest Nielsen Global Survey of Consumer Confidence and Spending released today.

Just under three-quarters (74%) of Filipino consumers say local job prospects are good/excellent in the next 12 months compared to the global average of 48%. Almost eight in 10 (79%) perceive their state of personal finances to be in good stead while 46% believe it’s a good time to buy things they want and need.

“Filipino consumers have plenty of reasons to feel good: unemployment levels were at its lowest in the last quarter of 2015, the economy continues to be one of the strongest in the region, the flow of remittances from overseas is steady, and the last quarter was when additional income from Christmas bonus and 13th month were paid out,” says Stuart Jamieson, managing director, Nielsen Philippines.

The Nielsen consumer confidence index measures perceptions of local job prospects, personal finances and immediate spending intentions, among more than 30,000 respondents with Internet access in 61 countries. Consumer confidence levels above and below a baseline of 100 indicate degrees of optimism and pessimism.

In the latest online survey, conducted Nov. 2–25, 2015, consumer confidence increased in 26 of 61 markets measured by Nielsen (43% of measured markets). India’s score of 131 was the highest level, with no change from the third quarter, and South Korea’s was the lowest at 46, a quarterly rise of four points. Among the world’s largest economies, China’s score was 107, a rise of one point from the third quarter, followed by the U.K. (101), the U.S. (100), Germany (98) and Japan (79), which all showed quarter-on-quarter confidence declines.

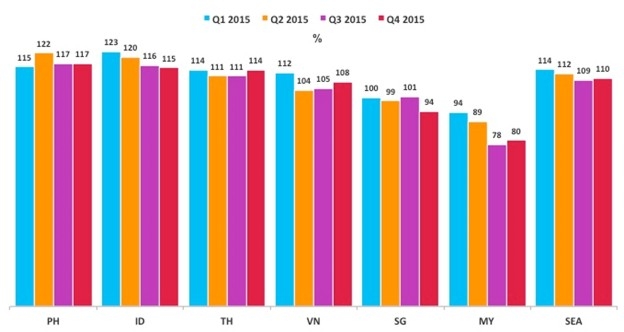

In Southeast Asia, Consumer Confidence Index score for Q4 2015 across all Southeast Asian markets was high at 110. Indonesia closely follows the Philippines as the third most confident consumers globally, with a score of 115, dropping one point from Q3 2015. Thailand (ranked 4th globally) gained three points with a score of 114 while Vietnam rose to sixth place from previous rank at 10th place globally with a Consumer Confidence Index score of 108, up three points quarter-on-quarter. Malaysia which suffered the worst decline in Q3 gained back two points to settle to a score of 80. Meanwhile, Singapore saw consumer confidence fall to a score of 94 in the fourth quarter, a seven-point decline from the third quarter. (See Chart 1).

WILLINGNESS TO SPEND

While consumers in the Philippines continue to give financial security top priority by channeling spare cash to savings (65%, -2 from Q3), they have also indicated willingness to spend.

“The upbeat percept on personal finances, the country’s economy, and job prospects encourages consumer spending on discretionary items,” notes Jamieson.

Discretionary purchase intentions high on the priority shopping list of consumers in the Philippines include spending on holidays/vacations (27%, +1), new technology products (25%, +2), and out of home entertainment (14%, +3).

CHART 1: NIELSEN CONSUMER CONFIDENCE INDEX, SOUTHEAST ASIA, 2015

ABOUT THE GLOBAL SURVEY METHODOLOGY

The findings in this survey are based on an online methodology in 61 countries. While an online survey methodology allows for tremendous scale and global reach, it provides a perspective only on the habits of existing Internet users, not total populations. In developing markets where online penetration is still growing, audiences may be younger and more affluent than the general population of that country. Three sub-Saharan African countries (Kenya, Nigeria and Ghana) utilize a mobile survey methodology and are not included in the global or Middle East/Africa averages discussed throughout this report. In addition, survey responses are based on claimed behavior rather than actual metered data. Cultural differences in reporting sentiment are likely factors in the measurement of economic outlook across countries. The reported results do not attempt to control or correct for these differences, therefore, caution should be exercised when comparing across countries and regions, particularly across regional boundaries.

![[Industry Survey]](https://pana.com.ph/wp-content/uploads/GLOBE-1-400x250.jpg)