Manila, PHILIPPINES, 09 JUNE 2015 – With the projected expansion of cities and urban centers in the next 10 years, expect the convenience-driven lifestyle to be a key influencer to Filipinos’ shopping habits and way of life. This is according to the latest Shopper Trends report from global performance management company, Nielsen.

Shopper Trends is a syndicated annual report that Nielsen conducts across 54 markets globally. It provides a comprehensive overview of retail environment trends and an understanding of shopping behaviour across the different trade channels. It provides insights on where, when, and how often people shop, and their emotional commitment and perceptions about key modern trade retailers.

“We are now observing a trend towards premiumization and urbanization which is significantly influencing the way consumers are purchasing products. As growth goes beyond megacities to second-tier cities, expect a change into a more fast-paced lifestyle with growing purchasing power,” notes Lou-Ann Navalta, Nielsen’s Shopper Insights leader in the Philippines. “Time is becoming a precious commodity and to cope, consumers are looking and willing to spend for products and services which provide convenience.”

The latest Shopper Trends report reflects the increased patronage of convenience stores with 29% of Filipino shoppers saying that they have visited convenience stores in the past four weeks, compared to just 8% of the population in 2012.

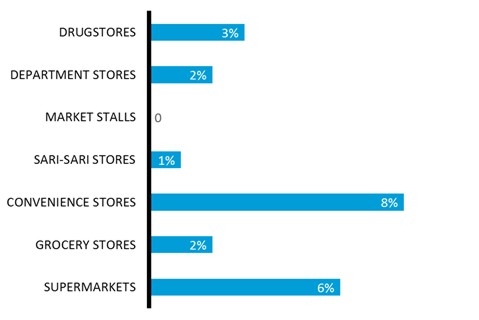

Matching the rising popularity of convenience stores among consumers is the exponential increase in store count. Convenience stores saw the most rapid expansion at 8% among retail channels with a store count of 2,900 compared to only a little over 1,000 stores in 2011. In comparison, supermarkets grew by 6% and grocery stores at only 2%. (See chart 1). Key players like 7-Eleven and Ministop have stimulated this solid growth as they have started to expand their footprint into the provinces. This growth is also driven by cross border investments from regional players such as Alfamart, Family Mart and Lawsons, which have partnered with local companies such as the SM Group and Ayala. Value sales in convenience stores have also increased 11% for YTD April 2014 vs. 2013.

“The chief mission in convenience stores in the Philippines is to buy a meal or snack or to fulfil a craving for a particular food or beverage,” observes Navalta. “Convenience stores are expanding their ready-to-eat (RTE) food assortment which offers the ‘quick fix’ that time-strapped shoppers need. To offer even greater convenience to their shoppers, a growing number of CV stores provide areas where shoppers can eat and socialize.”

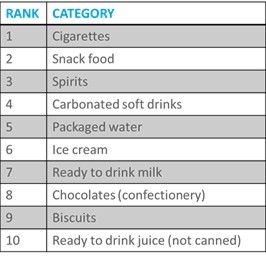

Aside from RTE meals, shoppers also go to convenience stores for quick shopping trips to satisfy an immediate need. Among the top 10 categories are various food and beverages that shoppers can grab quickly to satisfy an urgent need such as cigarettes, snacks, RTD beverages, spirits or ice cream. (See chart 2).

“For most urban Filipinos, convenience is starting to move beyond just a store format; convenience is evidently becoming a lifestyle,” declares Navalta. “Convenience stores and manufacturers alike should develop products, packaging, formats or sizes that are driven by the need for convenience. The store environment should always promote ease of shopping — allowing shoppers to get in and out of the store quickly —so they can opt to use their precious time doing activities that matter more to them.”

Chart 1. Store count growth

Source: Nielsen Retail Establishment Survey, 2014

Chart 2. Top 10 Categories in convenience stores, excluding RTE meals (based on value sales, Total Philippines)

Source: Nielsen Retail Audit, 2014

![[Industry Survey]](https://pana.com.ph/wp-content/uploads/GLOBE-1-400x250.jpg)