Ham sales grew by +234.5% during Christmas season 2019

Gift baskets will be the dominant trend as Filipinos move towards intimate gatherings

Pasig City, 02 December 2020 – The global retail sector is in an unprecedented state of flux and as the end of the year approaches Nielsen has identified a range of evolving consumer groups as well as four Holiday/Festive consumer behavioral resets related to this crucial holiday period.

Nielsen Retail Intelligence Managing Director for the Philippines, Patrick Cua comments; “As the end of the year approaches, upcoming festivities are going to look very different for consumers in the Philippines. With mobility and mass gathering restrictions still in effect, Filipino consumers will continue adapting to the homebody economy and will extend to how they celebrate Christmas during the pandemic. With cooking being central to festivities we predict a growth in baking and food category this year.”

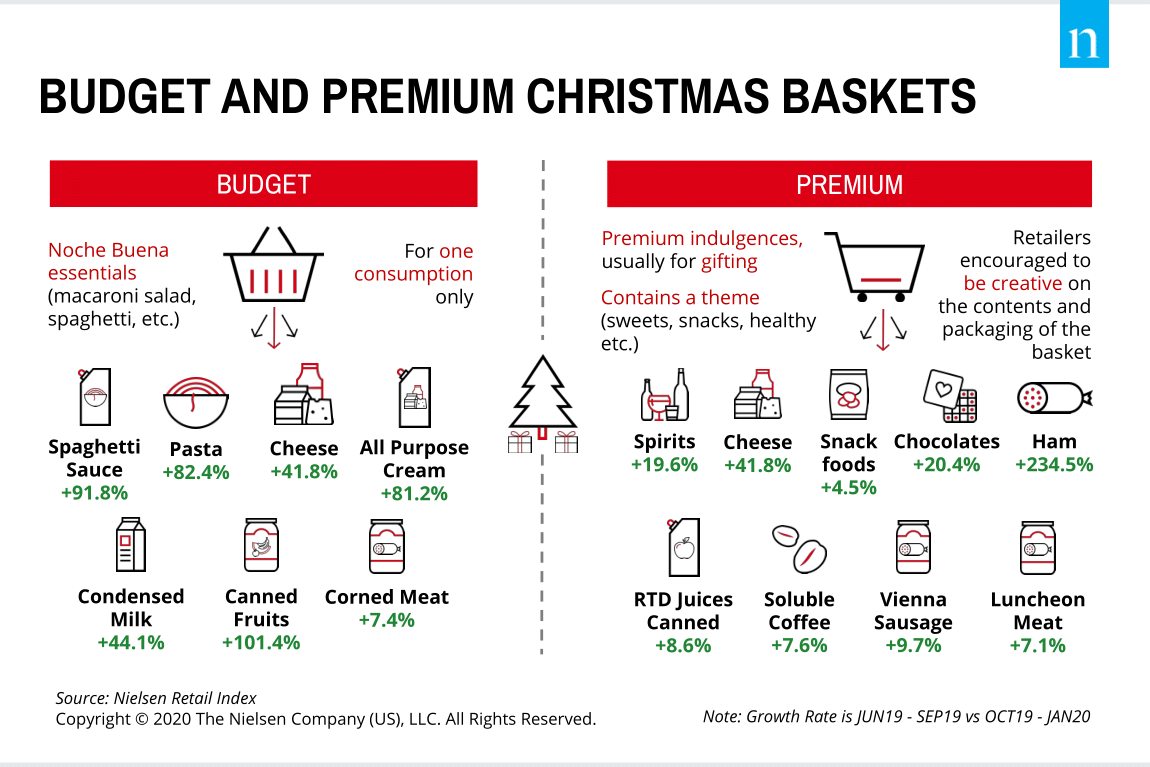

Chart 1: Budget and Premium Christmas Baskets Push Supermarket Sales

With Christmas celebrations being more intimate and smaller this year, food will be integral to this festive season. Nielsen predicts a rise in food categories such as ham, all-purpose cream, pasta, and canned foods (Refer Chart 1 – Sales Value growth) across Budget and Premium cooking categories.

While constrained shoppers are looking at a single consumption, insulated shoppers are indulging in gifting food and health products. We see this as brands cater to both constrained and insulated shoppers during Christmas.

EVOLVING CONSUMER GROUPS

Against this backdrop Nielsen has identified five different consumer groups that indicate how financial and physical restrictions could manifest leading up to the festive season.

- Constrained and Restricted consumers have suffered income loss as a result of COVID-19 and have less money to spend and also have less freedom to physically congregate and shop for their holiday needs due to local restrictions to travel, business openings and social interaction. As a result of limited physical shopping, they may have less opportunity to shop around for the best deals and assortment.

- Constrained but Free consumers have also suffered income loss and are likely to have a savings mindset as they prepare for the festive season but because they have no physical restrictions, they will have more freedom to celebrate with others and to seek the right products and price points to suit their needs.

- Cautious Middle consumers have not yet been impacted financially and their celebrations are not limited by local physical restrictions. They are more likely to be cautious spenders and may prioritize occasions and gift giving with only those closest to them.

- Insulated but Restricted consumers have not been financially impacted by COVID-19 but festivities will be impacted by local physical restrictions. Smaller gatherings may curtail normal spending and encourage self-indulgent celebrations. Financial flexibility will drive these consumers to splurge in some ways to compensate for experiences that are no longer possible (e.g. travel).

- Insulated and Free consumers have also not been financially impacted by COVID-19. While their social interactions may not be restricted, their typical celebrations may be affected by those unable to be with them this year. These consumers are likely to spend the most freely and to exhibit pre-COVID-19 holiday behavior.

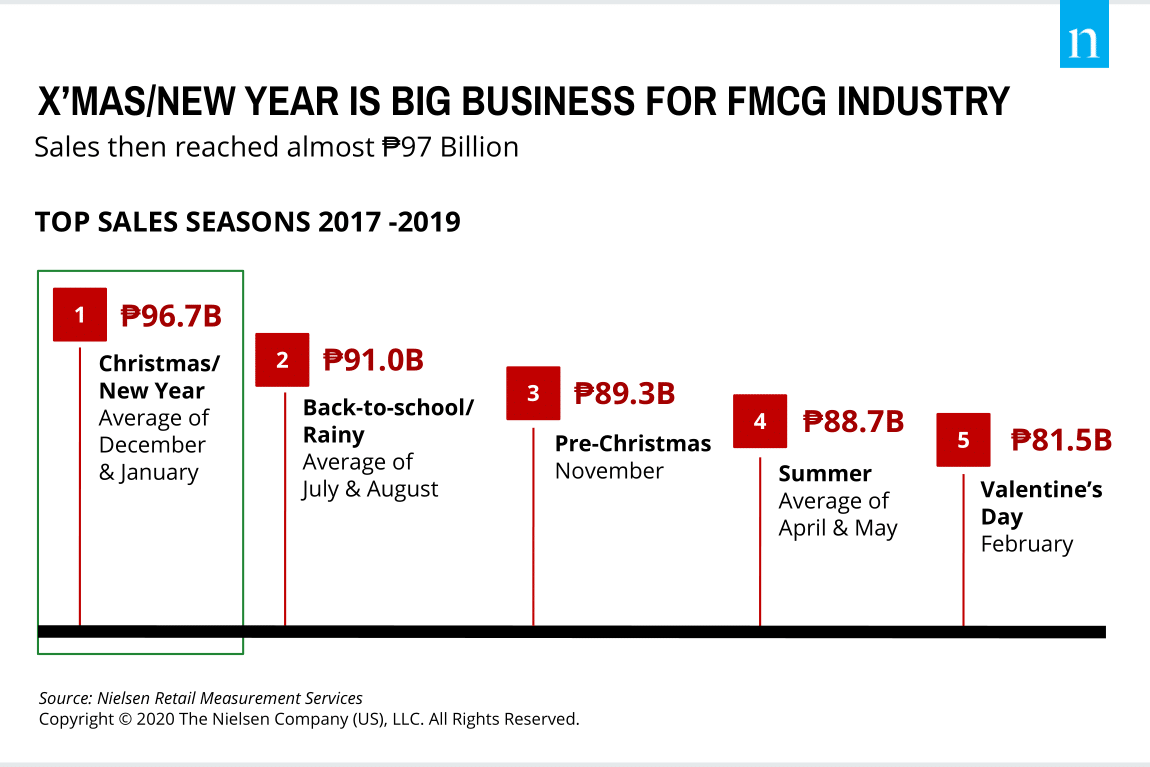

Chart 2: Christmas season is big business in the Philippines for FMCG industry

With Christmas sales reaching 97 billion pesos from 2017 to 2019, Nielsen expects a rise in FMCG sales in December 2020 ( refer chart 2). Within this new festive framework Cua points out, “Manufacturers would need to adopt different strategies to appeal to both the constrained and insulated shopper. Packaging, promotions and bundled deals would be key to win the Christmas shopper. With a slowly stabilizing economy, we predict that discount value shopping will power holiday consumer behavior in 2020.”

NEW PURCHASE BEHAVIORS

To help chart the behavior of these consumers, Nielsen has also identified four emerging patterns to help predict the drivers of pandemic purchase decisions in future. When applied to the context of the many upcoming holidays and year-end festivities, these reset patterns now highlight some important new behaviors that could emerge this season.

- Basket Reset – Holiday spending and gifting will be refined based on what and who are considered essential for each consumer. This will require retailers and manufacturers to redefine what’s festive and capitalize on the broadened assortment of what consumers might consider “giftable” this year. From a necessity that can no longer fit the budget, to a product that has been harder to get in stores this year, there will be big shifts in what defines a “gift”.

- Homebody Reset – Gatherings will be smaller and more intimate with many planned at the last minute. This might see the introduction of so-called ‘Single-Serve Celebrations that cater to needs for convenience, health and budget consciousness by offering serving sizes and packages conducive to small or socially distanced gatherings.

- Rationale Reset – Consumers will spend more on themselves, prioritizing self-care this year. Retailers might then look to engage with empathy and recognize the trade-offs consumers will need to make. There is also scope for just-in-case solutions that cater to consumers who may be waiting to see whether they are able to physically celebrate a festive occasion or not.

- Affordability Reset – Online shopping will power more holiday consumer behaviors than ever before creating a need to convert impulsivity. With limited physical touchpoints with consumers, it’ll be vital to create spontaneity, even in an online environment.

ABOUT NIELSEN

Nielsen Holdings plc (NYSE: NLSN) is a global measurement and data analytics company that provides the most complete and trusted view available of consumers and markets worldwide. Nielsen is divided into two business units. Nielsen Global Media provides media and advertising industries with unbiased and reliable metrics that create a shared understanding of the industry required for markets to function. Nielsen Global Connect provides consumer packaged goods manufacturers and retailers with accurate, actionable information and insights and a complete picture of the complex and changing marketplace that companies need to innovate and grow.

Our approach marries proprietary Nielsen data with other data sources to help clients around the world understand what’s happening now, what’s happening next, and how to best act on this knowledge.

An S&P 500 company, Nielsen has operations in over 90 countries, covering more than 90% of the world’s population. For more information, visit www.nielsen.com.

![[Industry Survey]](https://pana.com.ph/wp-content/uploads/GLOBE-1-400x250.jpg)